BPS provides an integrated and comprehensive approach to capital planning to help organizations achieve a balanced mix of IT investments that can support current and emerging business needs. Our comprehensive approach ensures the operational needs of the CPIC program are fully supported, while also executing targeted, strategic improvement activities to ensure programs achieve robust CPIC capabilities.

We provide in-depth support throughout the CPIC process, including providing training and developing presentation documents using technical specifications to organize, format, and present content for CPIC briefings, brochures, articles, and training manuals tailored to specific audiences. We will provide training, mentoring, and one-on-one sessions to improve the IT portfolio management and governance processes, in addition to developing CPIC artifacts based on OMB guidance and industry best practices to enable better management of the IT portfolio.

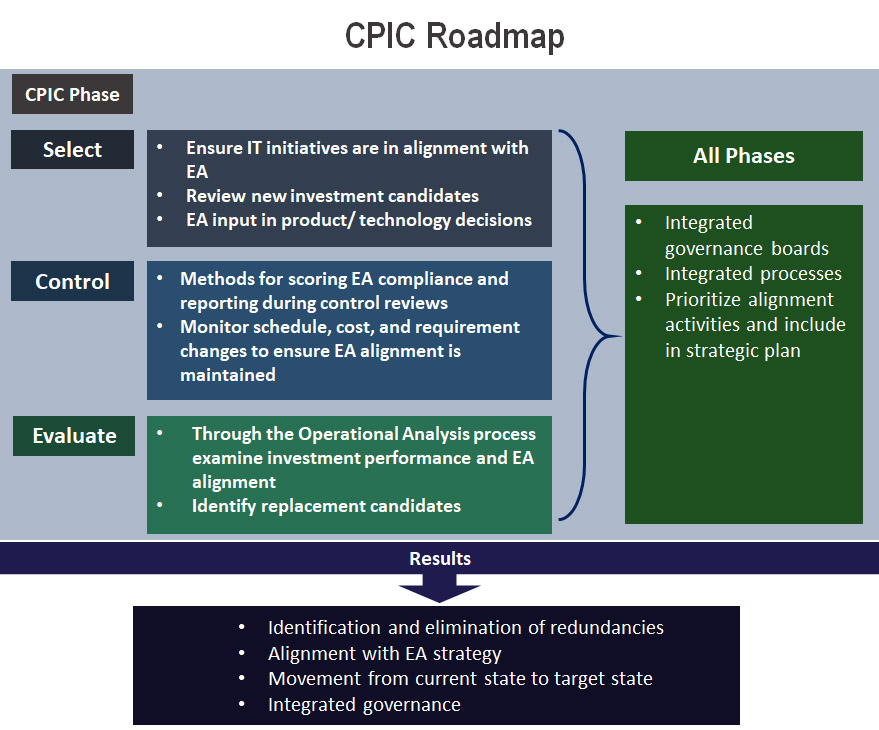

Our integrated financial management support approach incorporates assessment, gap analysis, categorization and review, roadmap, and action plan development to bridge gaps. We successfully guide initiatives through the CPIC Phases:

- Select Phase. In the Select phase, we will work collaboratively with stakeholders and federal counterparts to ensure the IT investment portfolio is composed of the appropriate range of investments that will best support the organization's mission and strategic goals.

- Control Phase. In the Control phase, we will monitor the major investments, non-major investments, and standard investments to ensure that adequate management oversight and quality control processes are in place to increase the probability of success for the organization's initiatives.

- Evaluate Phase. BPS will facilitate and validate submissions and provide concise and objective assessments to enable the organization to determine if investments have met stated objectives by delivering the benefits and requirements outlined in the business case.